Minimising risks in the heart of Europe

As long as things are running smoothly there is hardly any reason to change tried-and-tested ways for freight transportation – and risk management gets postponed. There are always projects urgently to complete and the day-to-day business comes first.

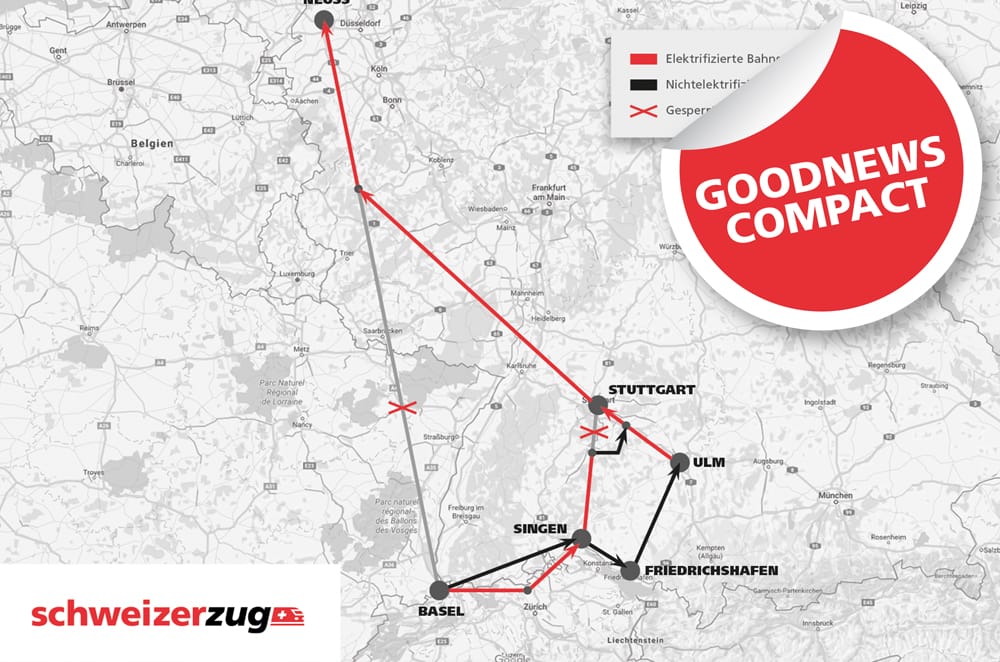

In many cases, this attitude has changed since last summer. In August 2017, the Rhine valley rail corridor was disrupted close to the German city of Rastatt, which led to a long and painful time for shippers and transport companies. The repercussions of this event had been barely absorbed when a tragic incident close to Milan (Italy) caused a disruption for rail traffic in that area. The southern links to Genoa and La Spezia as well as north to Frenkendorf and further on to Rotterdam were heavily affected. The importance of dealing with alternative transport options instead of using just a single route was once again made very clear.

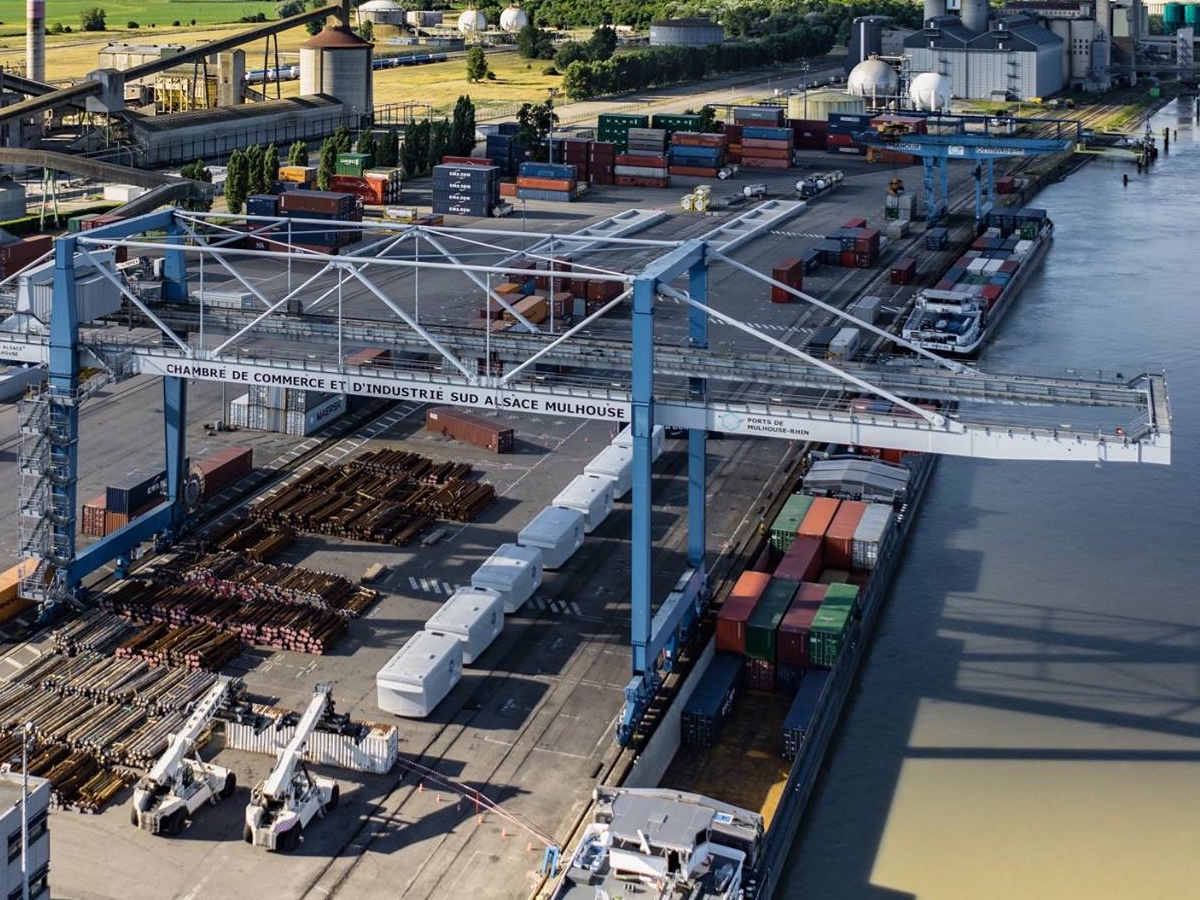

Being located in the heart of Europe, Switzerland is in a great position to act as a hub for various shipping options. For example, Frenkendorf close to Basel is perfectly situated to connect the country and adjacent regions to Rotterdam and Antwerp in the north as well as to the Italian ports Genua and La Spezia in the south. More and more shippers are using the respective rail freight corridors in parallel to get goods to or from Asia from A to B, minimising the risk to get stranded in case of an issue.

At present, the balance between the market share of Med Gateways, which include Marseille-Fos and Venice in addition to La Spezia and Genoa, and North Gateways that comprise Rotterdam, Antwerp, Bremen/Bremerhaven and Hamburg stands at about 30/70 per cent according to Ocean Shipping Consultants. However, once the final part of the New Rail Link through the Swiss Alps (NRLA/NEAT) as part of the Rhine-Alpine Corridor will have been completed, this balance might shift to about 45/55, most importantly due to a better connectivity. The capacity of the Rhine-Alpine freight corridor will increase significantly through the upgrade. Hence, the analysts at OSC are expecting the market shares of Med Gateways to grow to 45 per cent. It is true, hubs in the North are still claiming a larger share of the market, but the gap is shrinking.

When purely analysing those costs that shippers in Switzerland are facing when shipping cargoes overseas, conditions could already change in the near future in favour of Med ports. Factors like costs for bunker, road and rail haulage as well as the level of efficiency of port operations are playing a big role. Add to that the shipping lines’ respective strategies and you know that things are not likely to stay the same indefinitely.

However, the northern link is being improved as well. Germany aims to modernise its tracks between Karlsruhe and Basel by 2013. Extension work on this 180-km long part of the Rhine-Alpine corridor is urgently needed and follows projects of Switzerland and the Netherlands, where the extension to four tracks has already been completed.

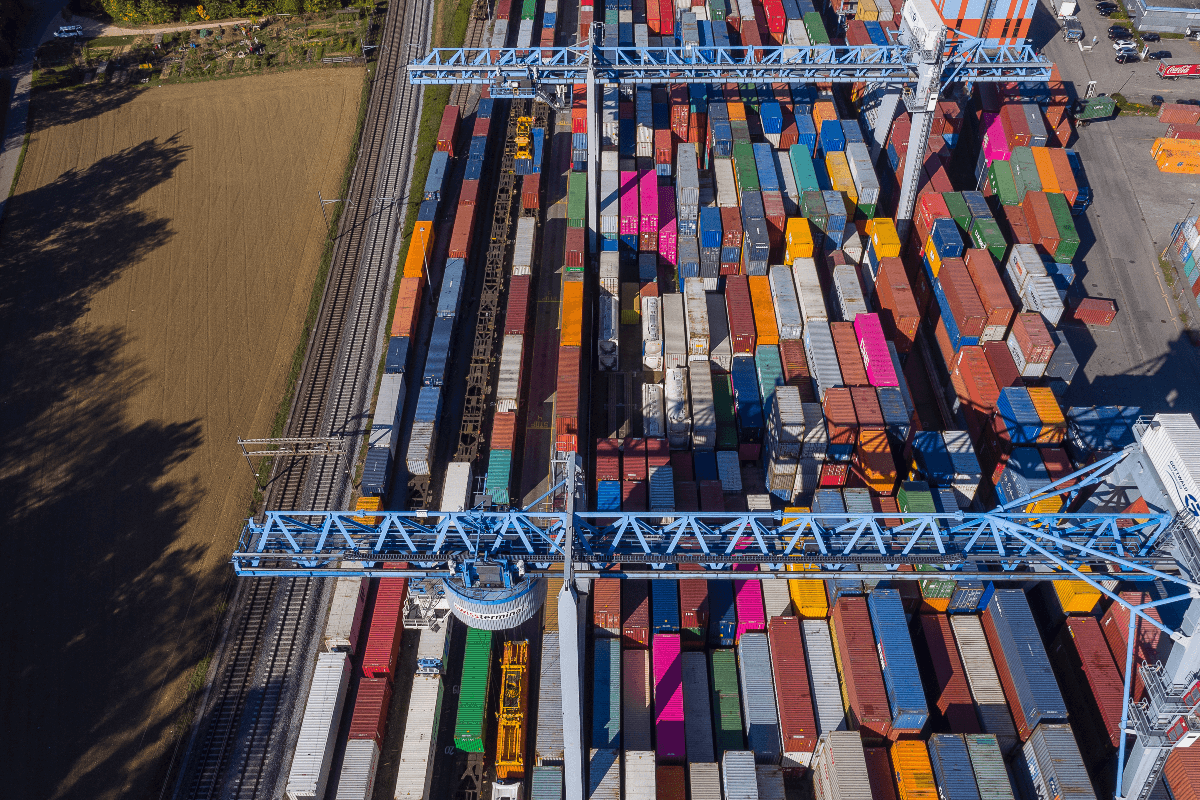

Logistics companies such as Swissterminal will benefit from these developments. The company operates its Schweizerzug with three departures per week and connects its sites in Frenkendorf and Niederglatt with the ports of Rotterdam and Antwerp. On top of that, Contship Italia links Frenkendorf with its Rail Hub Milano through its Hannibal trains six times per week.

When it comes to running a smooth supply chain that features a solid risk management system, having various reliable transport choices available is crucial. Which option fits the respective cargo best will always depend on the individual company. However, Swissterminal Group as link between north and south is the right partner in any case.